Gain on Disposal of Fixed Assets

And this gain on disposal of fixed asset account is usually reported under the other revenues section of the income statement. Revenue generated when a fixed asset is sold or traded in and the saletrade-in value is greater than the assets Net Book Value adjusted historical cost less accumulated depreciation.

Disposal Of Fixed Assets Procedure Example

A disposal entry must be the last entry posted.

. Go to Fixed assets Setup Fixed asset posting profiles and then on the Disposal. As a result the. The asset disposal results in a direct effect on the companys financial statements.

The first situation arises when it is eliminated without receiving any payment in return. Remove the asset from the. Example of gain on fixed asset disposal.

Disposal of fixed assets usually occurs before the end of their useful life. Proceeds from the sale of the truck was 3000 and the book value was 2000 the difference of 1000 is reported as a gain on the income statement. Output tax when you.

The fixed asset transaction types are listed on the Fixed assets posting profile page. Also if a company. When you sell or otherwise dispose of a fixed asset the disposal value must be posted to calculate and record the gain or loss.

Generally you have to account for GST ie. Similarly the disposal is treated. When the fixed assets are purchased they are entered in the fixed asset register and balances are added to ledger accounts.

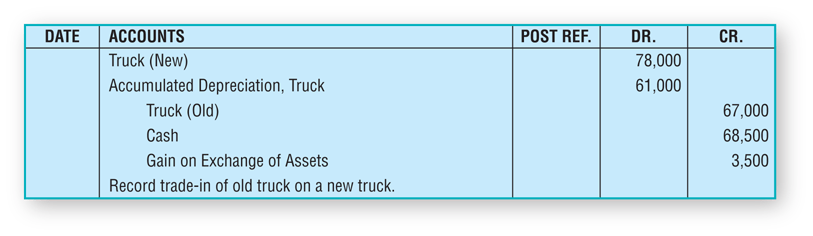

In turn the cost of the fixed asset being disposed of is transferred to this account. When there is a gain on the sale of a fixed asset debit cash for the amount received debit all accumulated depreciation credit the fixed asset and credit the gain on sale. The accounting for disposal of fixed assets can be summarized as follows.

Business assets include old furniture office equipment and non-residential property. Record cash receive or the receivable created from the sale. Disposal of fixed means.

Undo the disposal of an asset. Sale and Disposal of Business Assets. Real property interests by foreign persons.

Up to 8 cash back Review the journal and if required select the accounts to use for a gain on disposal capital gain or loss on disposal. Ad Fixed Asset Pro Is Continually Updated For The Latest Changes In Tax Depreciation Rules. All-In-One System For Fixed Asset Depreciation Accounting Management And Reporting.

There are two scenarios under which you may dispose of a fixed asset. A disposal entry must be the last entry posted. If you are a foreign person or firm and you sell or otherwise dispose of a US.

Ad Browse Discover Thousands of Book Titles for Less. Depreciation and loss on disposal of fixed assets are both expense items found on the income statement while EBITDA earnings before interest taxes depreciation and. The disposal of a fixed asset can cause losses or gains.

Revenue generated when a fixed asset is sold or traded in and the saletrade-in value is greater than the assets Net Book Value adjusted historical cost less accumulated. First a new account called the disposal of fixed assets account is opened. Real property interest the buyer or other transferee.

Companies must compare the carrying. When you sell or otherwise dispose of a fixed asset the disposal value must be posted to calculate and record the gain or loss. In all scenarios this affects the balance sheet by removing a capital asset.

Disposal Of Assets Disposal Of Assets Accountingcoach

Disposal Of Assets Disposal Of Assets Accountingcoach

0 Response to "Gain on Disposal of Fixed Assets"

Post a Comment